The UK’s competition regulator is conducting a deeper investigation into Broadcom’s $61bn acquisition of VMware.

Broadcom had five working days to come up with revisions that satisfy the Competition and Markets Authority’s (CMA) concerns.

The CMA has highlighted that the takeover could affect competition across ethernet network interface cards, fibre channel host bus adapters, storage adapters and fibre channel switches.

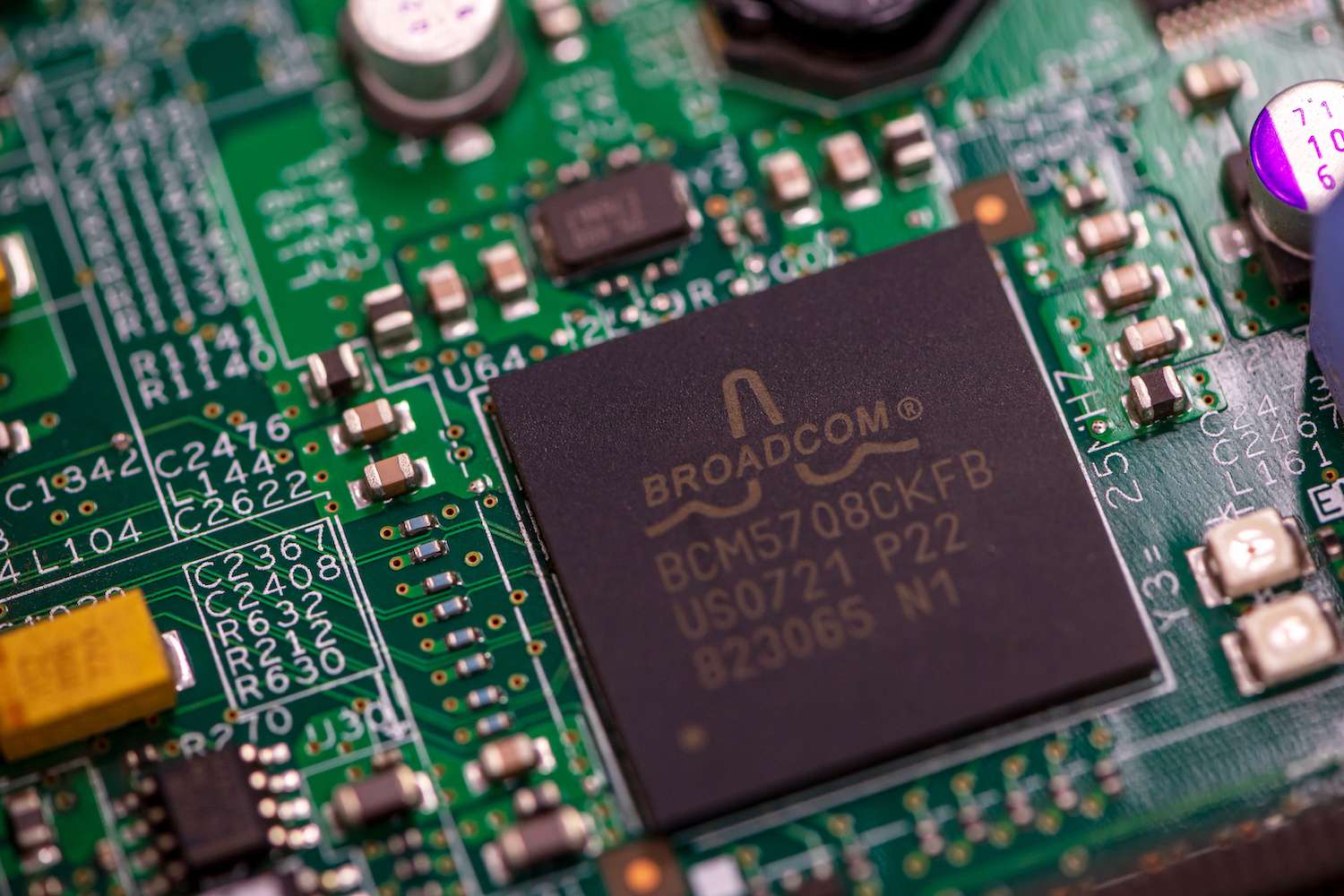

Broadcom makes semiconductors and infrastructure hardware, whilst VMware offers cloud and virtualisation technology.

In a statement, the CMA said: “The CMA has referred the anticipated acquisition by Broadcom Inc. of VMware, Inc. for an in-depth investigation, on the basis that, on the information currently available to it, it is or may be the case that this Merger may be expected to result in a substantial lessening of competition within a market or markets in the United Kingdom.”

While both companies are based in the US, the competition regulator has the power to prevent the acquisition and has done so in the past, unwinding Meta’s acquisition of Giphy.

VMware said: “Broadcom’s acquisition of VMware continues to move forward as expected, including with respect to the regulatory review process taking place in the UK and those across multiple other jurisdictions.

“VMware will continue to respond to all regulatory inquiries, as appropriate, and we continue to expect the deal to close in Broadcom’s fiscal year 2023.”

UKTN has reached out to Broadcom for further comment.

Alex Haffner, competition partner from law firm Fladgate, said: “The CMA’s decision on the proposed tie-up between Broadcom and VMWare is the first one by a competition regulator to express concerns about its impact on competition on any relevant market – it has to date received clearances from Australia, Brazil and Canada.”

The deal is also under examination by the European Commission.

The CMA first launched an investigation into Broadcom and VMware in November, after the deal was announced in May. At the start of the year, the CMA then continued with a merger inquiry.

Atlantic Money has also contacted the European Commission this month in an escalation of its dispute with Wise, following a letter to the CMA.